On Oct. 2, several major altcoins, including STRK, AR, LDO, and CORE, experienced double-digit losses as geopolitical tensions and long liquidations hit the crypto market.

Starknet (STRK) led the altcoin losses, dropping 13.4% over the past 24 hours. Trading volume remained around $151 million, while its market capitalization shrunk by 13.75%, now sitting at $772 million.

Similarly, Arweave (AR) fell 14.3% to $19.98, with a daily trading volume of $226 million and a market cap of $1.3 billion—its lowest point in the last seven days.

Lido DAO (LDO) also suffered, down 12.7%, trading at $1.16. Lido’s market cap declined to $1.03 billion, with a daily volume of $179 million. Core (CORE) followed suit, slipping 12.4% to $0.9292, with $50.4 million in daily trading volume and a market cap reduced to $851 million.

Broader market conditions and Bitcoin’s role

The sharp decline in these altcoins coincided with a broader contraction in the cryptocurrency market, which saw its total market capitalization drop by over 5.5% to approximately $2.26 trillion. The downturn occurred against a backdrop of rising geopolitical instability, including Iran’s missile strikes on Oct. 1 and a pullback in US equities, which compounded a weakening investor outlook for the traditionally bullish “Uptober.”

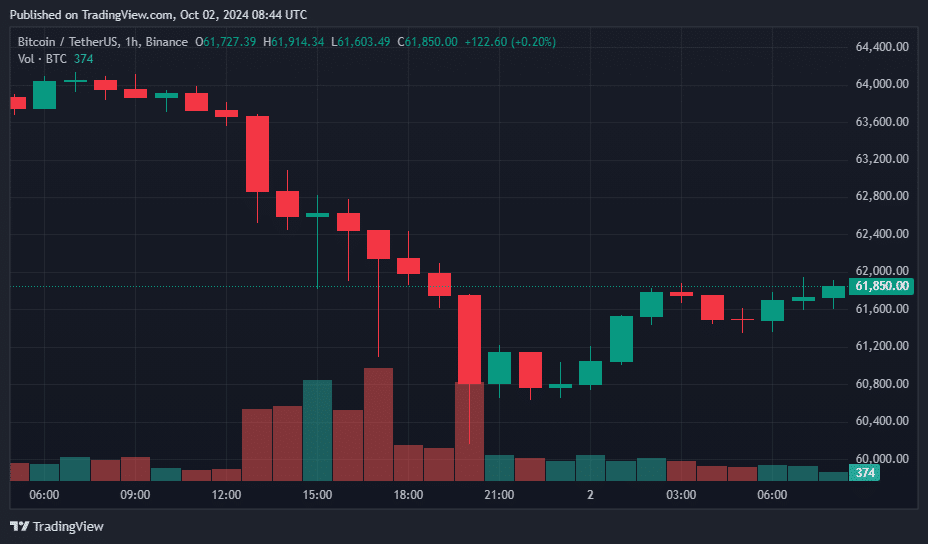

Bitcoin (BTC), the market’s anchor asset, dropped 3.2% in the last 24 hours, shedding nearly $4,000 hitting a two-week low of $60,315 earlier today, per data from crypto.news. The decline was partially driven by geopolitical developments, which spurred sell-offs in risk assets across global markets.

Though Bitcoin has recovered slightly to $61,850, its price action stands in stark contrast to that of traditional safe-haven assets such as gold and oil. Gold surged 1.4% to $2,665 per ounce, nearing a record high, while crude oil spiked 7% to $72 per barrel.

The rising value of gold, oil, the US dollar, and bonds highlights the divergence between Bitcoin and traditional hedges, raising questions about Bitcoin’s status as a store of value during times of crisis.

Liquidations amplify market downturn

Data from CoinGlass shows the scale of market turbulence, with $453 million in long positions liquidated over the past 24 hours, compared to $72 million in short positions. This liquidation of long trades, where investors bet on price increases, added to the selling pressure, further accelerating the drop.

This cycle of liquidations and sell-offs, particularly in a volatile market, tends to ripple through the altcoin sector, dragging down the broader market.

Bitcoin needs to secure $71K

Veteran trader Peter Brandt remarked that despite Bitcoin’s rally in the last weeks of September, it remains trapped in a seven-month pattern of lower highs and lower lows.

According to Brandt, only a close above $71,000, accompanied by a new all-time high, would confirm that Bitcoin’s upward trend, which began in November 2022, remains intact.

The Crypto Fear and Greed Index, which measures market sentiment, dropped from 59 last week (neutral) to 42 when writing, indicating a shift toward fear as geopolitical risks spook investors.

Historically, Bitcoin has exhibited heightened volatility during stressful periods, as seen earlier this year following the Israeli-Iranian conflict, which triggered a major price correction.

Looking ahead, the current geopolitical situation could continue to weigh on the market, particularly if the conflict escalates. Increased instability could spur further sell-offs, heightening volatility across the crypto space.