WOO’s price shot up 17% in the last 24 hours, ranking it as the top performer among the 300 leading cryptocurrencies.

WOO (WOO) was exchanging hands at $0.2109 at press time, marking a 59% rise from its monthly low of $0.1327. The asset’s market cap had surpassed $385 million, up from $284.9 million recorded at the beginning of September.

The WOO ecosystem offers a combination of centralized and decentralized financial services aimed at providing enhanced liquidity for cryptocurrency market participants. Its services include WOO X, a centralized exchange; WOOFi, a decentralized exchange; and Wootrade, a liquidity pool tailored for institutional clients.

South Korean traders are driving the rally, as CoinGecko data shows that the WOO/KRW pair on Bithumb alone generated over $36.8 million in 24-hour volume. Binance came in second, recording $23.5 million in trading volume.

This led to a staggering 691% surge in daily trading volume, which now stands at approximately $119.5 million.

Possible short squeeze approaching?

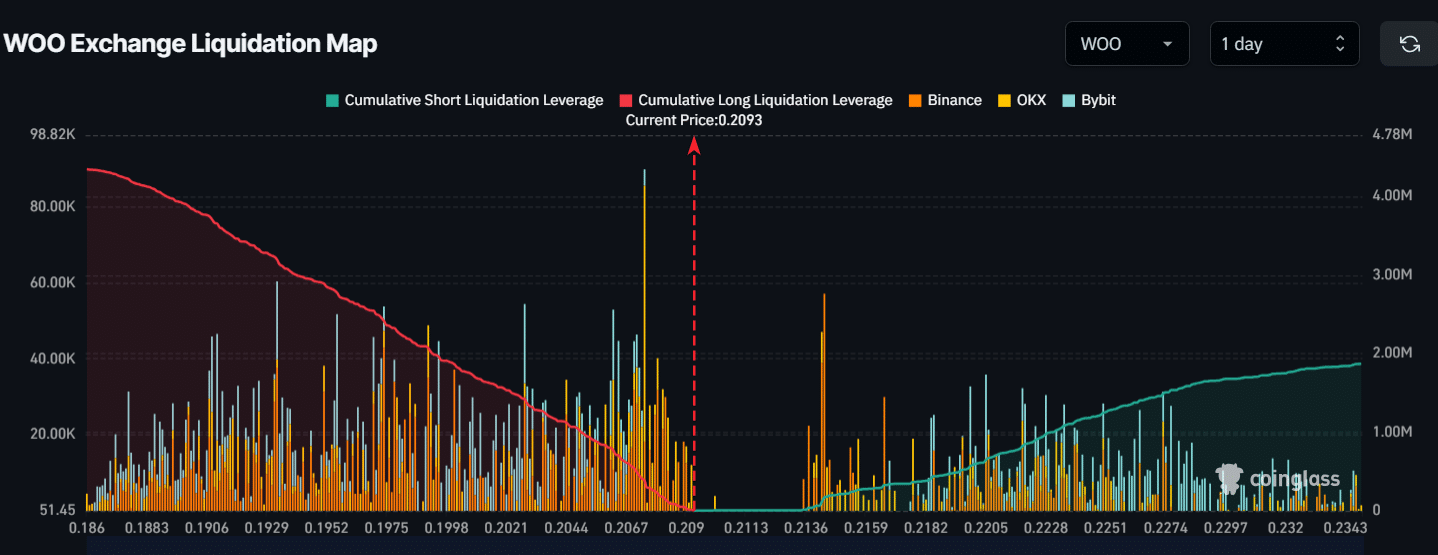

CoinGlass data shows WOO’s open interest jumped 81.4% to $20.16 million, alongside a boost in trading volume, pointing to more investor action.

WOO trading above its 50-day Moving Average signals strong bullish momentum, while an RSI above 76 indicates it’s entering overbought territory. This suggests potential for further gains but also raises the likelihood of a short-term pullback or consolidation as traders may start to take profits.

The critical liquidation thresholds for WOO are currently set at $0.2074 and $0.2143, with high leverage observed among intraday traders, according to CoinGlass. A drop to $0.2074 could trigger $358K in long liquidations, while a rise to $0.2143 might liquidate $168.92K in short positions.

At press time, data showed that bears dominated the market, increasing the likelihood of long position liquidations at lower price levels.

Further, WOO’s funding rate has dropped from 0.0055% to -0.0433%, suggesting a shift in sentiment to the bearish side. However, if the price continues to climb, it could trigger a short squeeze, pushing short sellers to cover their positions and possibly driving higher prices.

Amid the hype surrounding WOO among Korean traders, an X user questioned WOO X’s transparency principles, accusing it of pressuring exchanges to disable the sell button for WOO tokens. The user called the move “shady,” suggesting that despite WOO’s claims of openness, the community had noticed this questionable action.