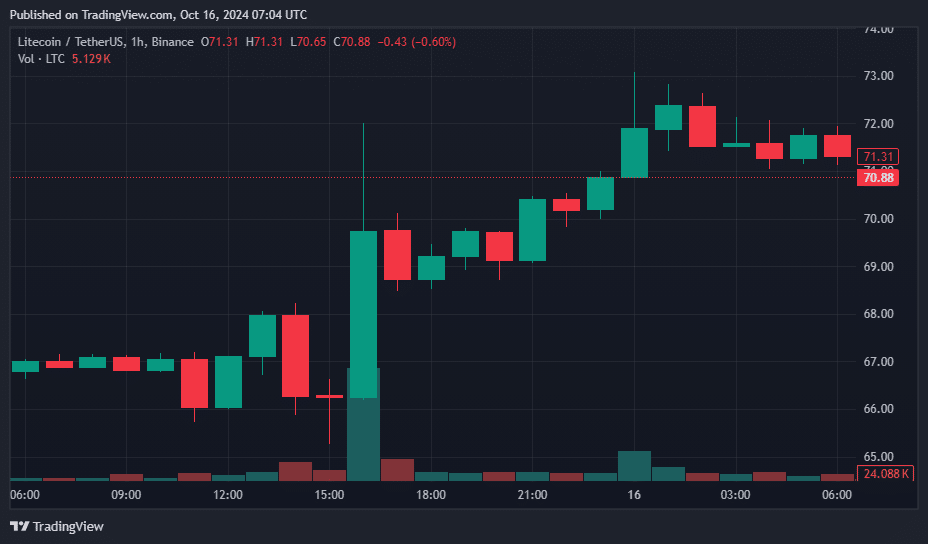

Litecoin surged to its two-month highs following the news of a spot Litecoin ETF filing with the U.S. Securities and Exchange Commission.

Litecoin (LTC) rose 7.2% over the last day, exchanging hands at $71.52 on Wednesday, Oct. 16, its highest price seen since the end of July.

This recent rally reflects a 15% increase from its monthly low, with Litecoin’s market capitalization growing from $4.6 billion on Oct. 3 to over $5.36 billion at the time of writing.

The upward momentum has also been mirrored in the futures market, where open interest for LTC futures contracts reached a multi-month high of $170 million. This rise in open interest indicates strong investor demand and heightened engagement with the asset.

ETF filing fuels Litecoin rally

The primary catalyst behind Litecoin’s surge is the announcement that Canary Capital, a crypto-focused investment firm, has filed an application with the SEC for a spot Litecoin exchange-traded fund. If approved, this ETF would grant both retail and institutional investors direct exposure to Litecoin, making it easier for them to invest in the cryptocurrency without the need to hold the asset directly.

Since the announcement, the token surged over 9% to hit a two-month high of $72.79.

In addition to the ETF news, broader market sentiment has played a role in Litecoin’s price rally.

The crypto fear and greed index, a widely followed indicator of market sentiment, has moved from a fear level of 38 last week to a greed reading of 77. This shift reflects an improving outlook for the crypto market overall, which is further supported by Bitcoin’s (BTC) recent ascent above $67,000, which also brought in gains for other altcoins like Ethereum (ETH) and Solana (SOL).

Historically, altcoins like Litecoin tend to perform well during periods of heightened optimism and rising market confidence in Bitcoin. Community sentiment around Litecoin was notably positive per CoinMarketCap data, while traders on X portrayed a similar outlook.

According to analyst ZAYK Charts, LTC has broken out of a descending channel on the 1-day chart, a pattern that typically signals a bullish reversal. ZAYK now expects the token to climb to $100 in the short term, representing a 28.5% upside from its current price.

One pseudonymous trader revealed that they have accumulated 0.1% of Litecoin’s total supply as part of a long-term investment strategy. This investor pointed to Litecoin’s durability and cited the Lindy Effect—the theory that the longer an asset has survived, the more likely it is to persist—as a rationale for their confidence. They also believe that once the current “meme-coin” bubble bursts, capital will flow back to established cryptocurrencies like Litecoin, which have stood the test of time.