ApeCoin has seen its price surge 50% in the last 24 hours following the launch of its cross-network bridge and other ecosystem developments.

ApeCoin (APE), the governance token of the APE ecosystem, rose from $1.21 to $1.53 its six-month high over the past day while its market cap surpassed the $1.1 billion mark.

The recent price rally of ApeCoin can primarily be attributed to the launch of ApeChain, a new Layer-3 blockchain. The cross-chain bridge enables seamless transfers of APE, Wrapped Ethereum (WETH), USD Coin (USDC), Tether (USDT), and Dai (DAI) between ApeChain, Ethereum (ETH), and Arbitrum (ARB) networks.

Following its launch, APE’s utility has expanded within the Yuga Labs ecosystem, the firm behind popular NFT collections like the Bored Ape Yacht Club. With the new bridge, APE tokens can now be used for yield farming, enabling holders to automatically generate returns on APE, ETH, and stablecoins, thereby adding to the token’s utility.

As the native gas token of ApeChain, APE plays a central role in paying transaction fees, voting within ApeCoin DAO, and serving as a payment method in Yuga Labs’ titles and real-world purchases.

Additionally, ApeCoin recently introduced a smart contract update, integrating the LayerZero Omnichain Fungible Token (OFT) standard, which allows APE to function as a governance token for ApeCoin DAO and facilitates transaction fees across multiple chains.

Several commentators on X noted that the recent surge in APE came as investors increasingly bought the token amid the fear of missing out on making significant gains. Typically whenever a meme coin crosses the $1 billion mark, investors expect a parabolic rise in its price driven by increasing belief in the token as it becomes less likely to be manipulated or be rug pulled.

$APE

so many people must be in fomo watching this pump like a beastthe reason of pump is the launch of #ApeChain

if you feel like you have missed out

the real game starts when we see a monthly candle sustain above 1.99 $ pic.twitter.com/Igr9h1hbMl

— LA𝕏MAN (@Theblockvlog) October 21, 2024

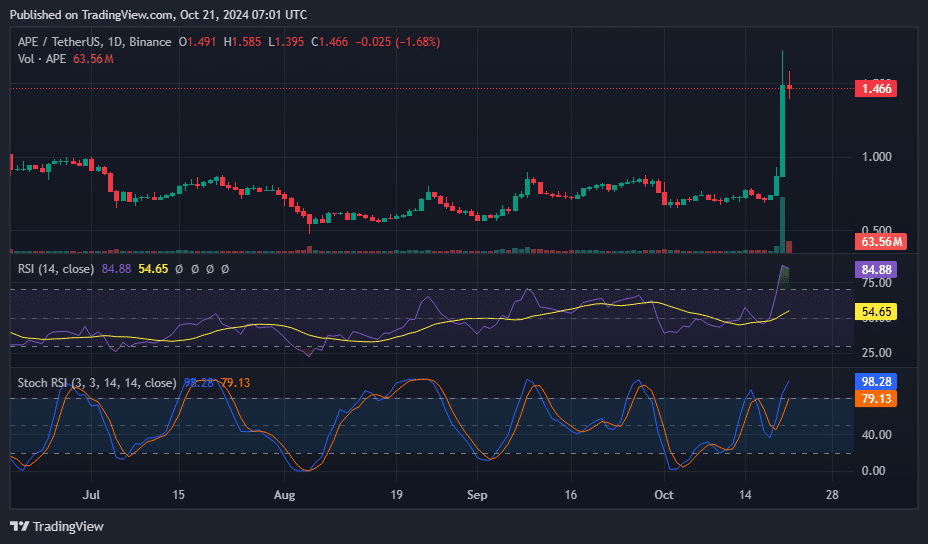

The Relative Strength Index and Stochastic RSI for APE were both above overbought levels at press time, which generally means a correction could be on the horizon. However, in the case of meme coins sustained interest from traders can help push prices higher as previously seen with several of ApeCoin’s contenders like POPCAT and WIF.

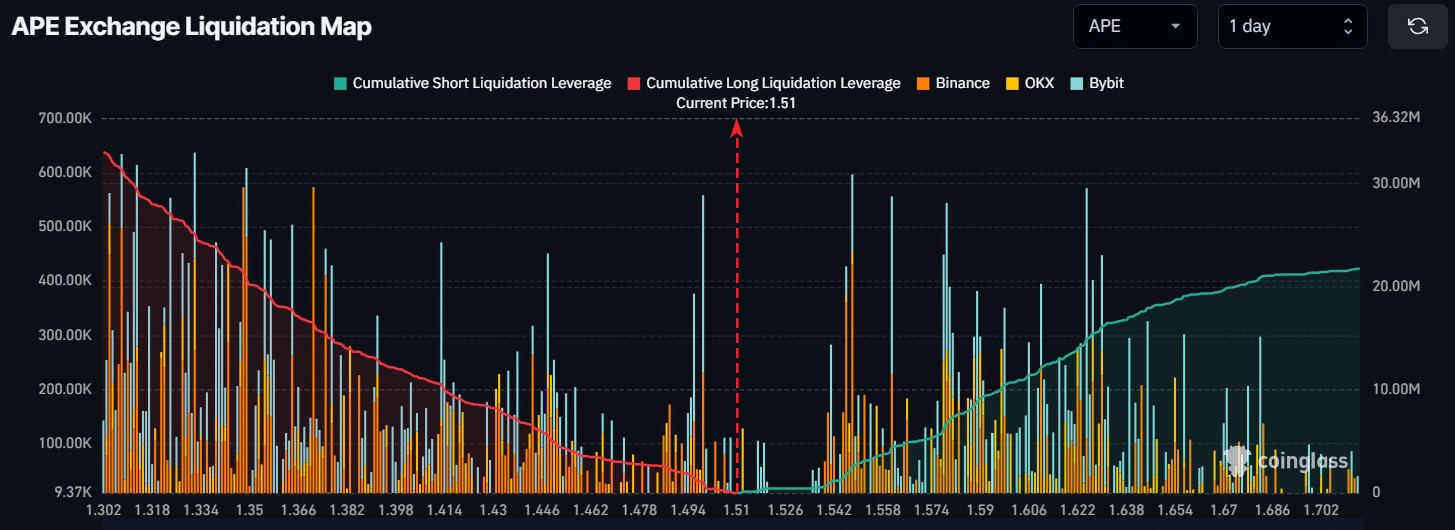

Currently, the key liquidation levels for APE are $1.548 on the upside, with most intraday traders leveraging around this level, per data from CoinGlass. If APE rises to $1.548, this could lead to the liquidation of about $2.59 million in short positions.