MANTRA rallied over 10% on Oct. 28 after a god candle formed on the daily chart.

Mantra (OM) surged to $1.40 over the lost 24 hours, marking a 66% increase from its September low after a ‘god candle’ propelled the token from $1.26 to $1.46, pushing its market cap to $1.22 million.

OM’s price rally comes as its daily trading volume surged three-fold, surpassing $92 million, with the majority concentrated on Binance.

One of the key factors behind OM’s rally is the recent launch of the MANTRA Chain mainnet which went live on Oct. 23, allowing users to bridge OM tokens from other blockchains to the MANTRA Chain Mainnet, enabling them to stake it to secure the network and earn staking rewards.

The MANTRA Mainnet offers a higher projected APR for staking compared to Ethereum, adding further incentive for users to migrate their tokens. Users have already bridged over 1 million OM tokens since the mainnet’s debut.

The hype surrounding an upcoming OM airdrop is also fueling the recent rally. As a part of the Mantra Zone competition, 50 million OM is set to be airdropped to ATOM stakers on the MANTRA Chain mainnet, which has ignited a lot of chatter about the altcoin.

A look at CoinGlass data shows a 43% rise in open interest on the futures market for the OM token, reaching $44.66 million, suggesting growing interest in the altcoin from short-term traders. Moreover, OM’s weighted funding rate has dropped sharply into the red zone at -0.0534%, suggesting that short liquidations could potentially drive the price higher.

Analysts anticipate further upside for the token with Pseudo-anonymous trader CryptoBull_360, speculating that OM could retest its all-time high of $1.61 if its trading volume continues to rise, suggesting a 13% gain from current price levels.

Another market commentator Altcoin Sherpa was also bullish on OM but urged followers to keep an eye on Bitcoin’s movement, which could be crucial, as its performance might drive the rally further.

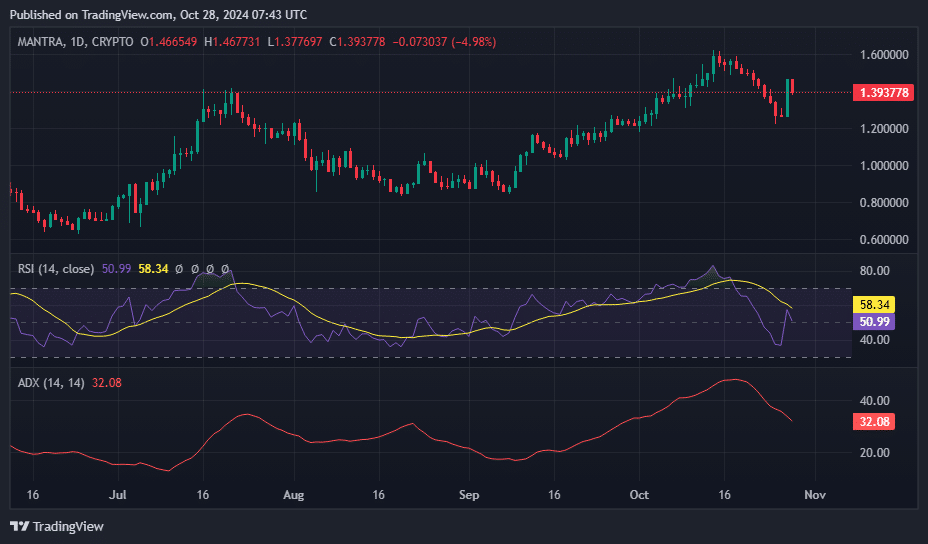

Technical indicators

On the daily chart, the Relative Strength Index, which had reached overbought territory on Oct. 14, has since declined, recently stabilizing at a neutral level of 50 as of Oct. 28—which typically means that the chances of price correction are unlikely in the short term.

Additionally, the Average Directional Index, a key metric for gauging trend strength, has climbed to 32, suggesting the trend has considerable strength.

Even though things look promising for OM, there’s still a concern for holders. According to IntoTheBlock, the net inflow of large holders to exchanges surged from 112.4k OM tokens on October 20 to 6.21 million tokens, valued at $8.9 million. This means whales are moving their tokens to exchanges, which is often a sign they might be preparing to sell.

This is particularly concerning since whales control 63% of OM’s supply, and with nearly 95% of holders currently in profit, the chances of this selling scenario playing is a possibility.