[ad_1]

Ethereum whales have been accumulating the asset as the Oct. 23 price drop brought a buying opportunity.

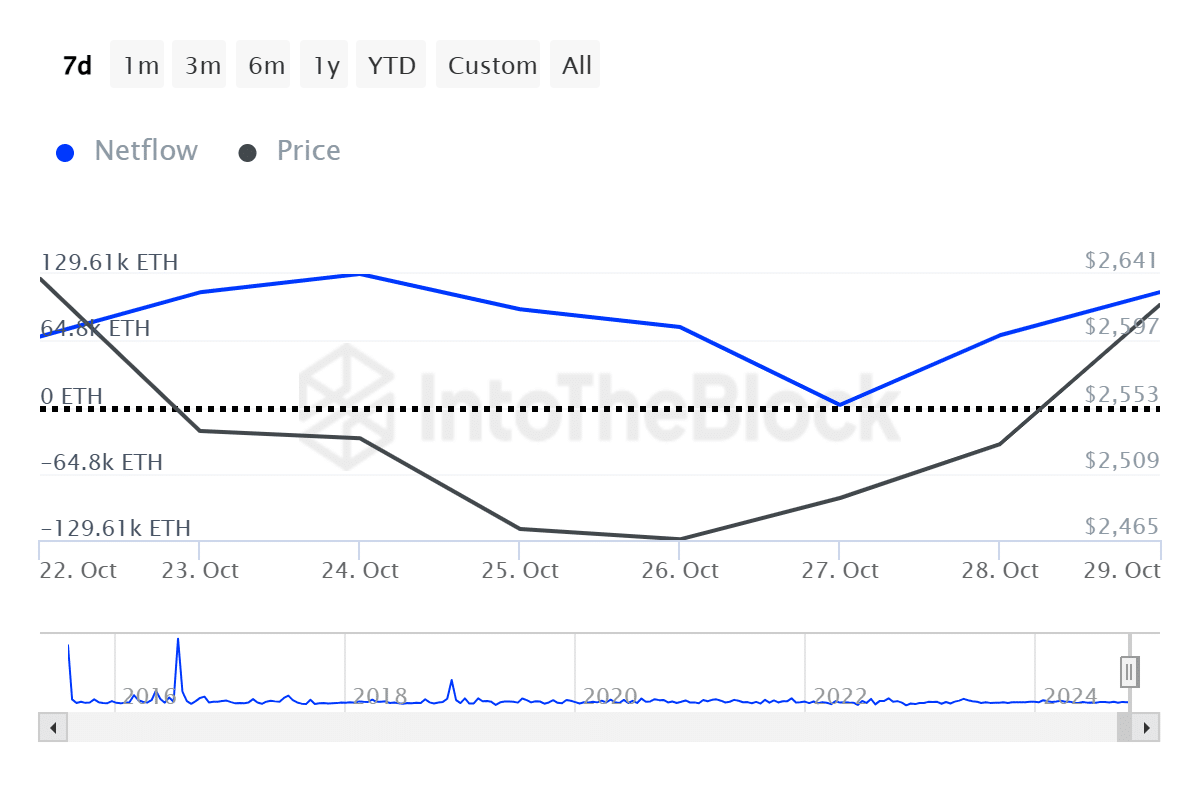

According to data provided by IntoTheBlock, large Ethereum (ETH) addresses saw a net inflow of over 598,000 ETH over the past week—worth $1.6 billion at the current price. The accumulation gained traction after the ETH price plunged from its local high of $2,765 between Oct. 21 and 23.

Ethereum gained 4% in the last seven days and is trading at $2,685 at the time of writing. Its market cap is currently hovering around $323 billion with a daily trading volume of $21.5 billion.

Data shows that the whale accumulation has also brought increased exchange outflows. Per ITB data, Ethereum saw a net outflow of $277 million on Oct. 29 and a total net outflow of $315 million over the past week.

The ETH large holder-to-exchange net flow ratio reached 10%, showing that whales have been more active than retail holders amid the price push above the $2,600 mark.

Moreover, Ethereum recorded a total of $38 billion in large transactions over the past seven days, ITB data shows.

High whale accumulation could trigger the fear of missing out, also called FOMO, among small token investors. This could potentially trigger upward momentum for the ETH price.

However, Ethereum lacks a strong bullish driver. Spot ETH exchange-traded funds in the U.S. have also been struggling since their launch in July—recording a total net outflow of $485.4 million.

[ad_2]