[ad_1]

Are current market conditions, including spot Ethereum ETFs and Bitcoin volatility, pointing towards an imminent altcoin season? Read on.

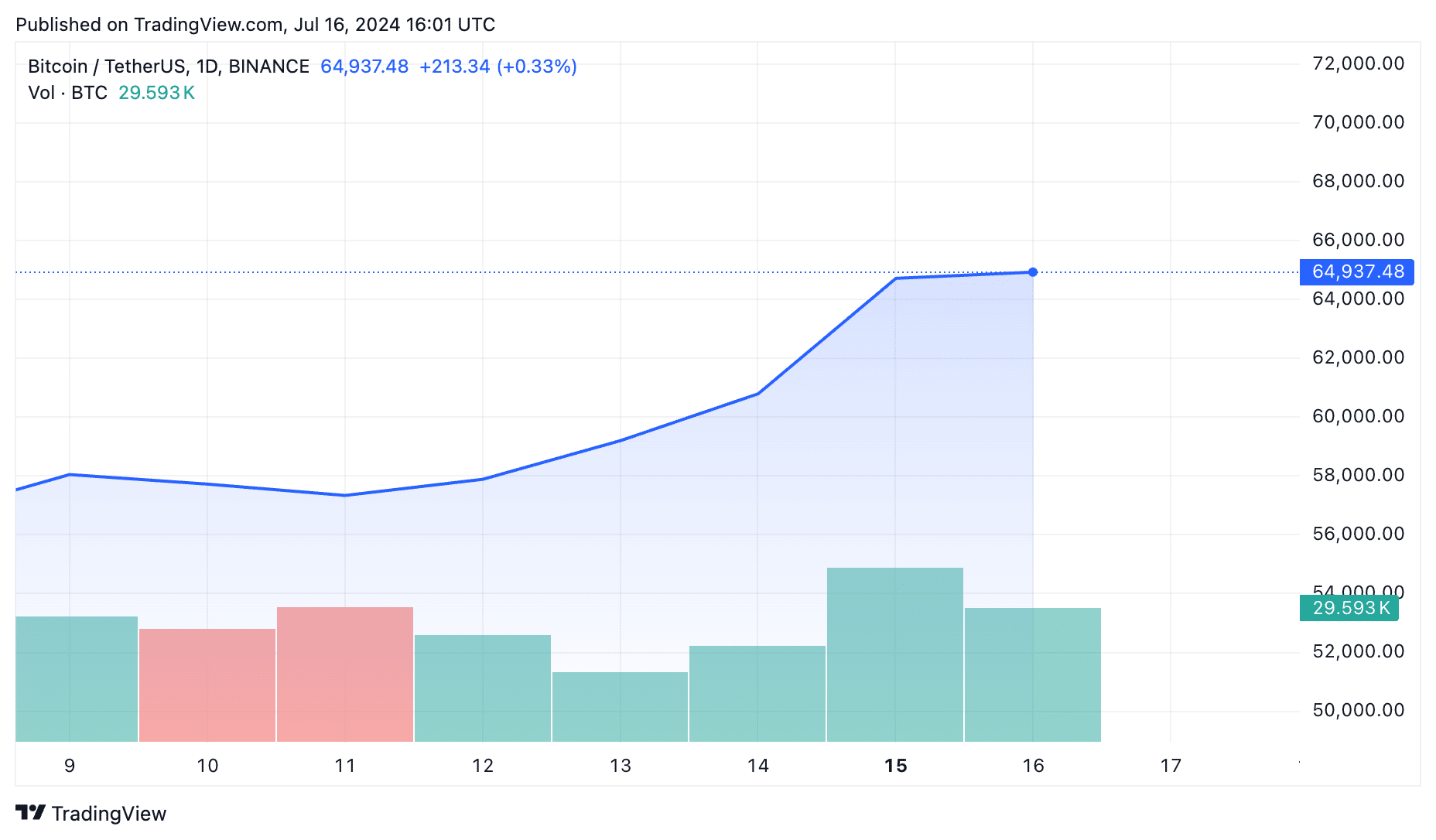

In recent weeks, the crypto market has experienced critical shifts, keeping everyone on edge. The turmoil began when the defunct Mt. Gox exchange started repaying its creditors, causing a sharp drop in Bitcoin (BTC) prices and triggering widespread panic, fueling speculation that the bull run might be over.

Adding to the uncertainty, the German government initiated a large-scale sell-off of its crypto holdings, pushing BTC prices down further to around $53,700 by July 5.

Despite these setbacks, Bitcoin climbed back to the $58,000 mark as the market absorbed the shocks from both the Mt. Gox repayments and the German sell-off.

However, the real game-changer came unexpectedly with a dramatic incident involving former U.S. President Donald Trump. Known for his pro-crypto stance, Trump was shot in the right ear during a political rally.

Post the attack, speculation surrounding Trump’s potential political comeback and its positive implications for the crypto market acted as a catalyst.

As a result, Bitcoin’s price soared from $58,000 to over $63,000 by July 14, briefly touching $65,000 on July 16 before settling at $64,937 at the time of this writing.

As if the market wasn’t volatile enough, another major development looms on the horizon: the approval of spot Ethereum (ETH) ETFs.

The U.S. Securities and Exchange Commission (SEC) has granted preliminary approval to at least three of the eight asset managers seeking to launch spot ETH ETFs. Final approval hinges on the submission of their S-1 documents to regulators by the end of this week.

The approved asset managers, including heavyweights like BlackRock, VanEck, and Franklin Templeton, are expected to receive the green light from the SEC on July 22, with trading in these new products slated to begin the very next day, on July 23.

With these events sending ripples across the crypto market, the big question remains: what does this mean for altcoins? Are we on the brink of an altcoin season, or will BTC and ETH continue to dominate?

Let’s delve into the data and market sentiment to uncover whether an altcoin season is indeed around the corner.

Altcoin dominance taking a hit

The altcoin market has been on a volatile ride recently, and understanding what’s going on requires looking at some important data.

First, let’s talk about Bitcoin dominance. Since November 2022, BTC dominance has been strengthening. Back then, Bitcoin’s share of the total crypto market was around 40%. It then climbed steadily and hit over 56% in April 2024. Since then, it’s been hovering between 54% and 56%, standing at nearly 55% as of July 16.

On the other hand, altcoin dominance (excluding top 10 coins by market cap) has followed a different pattern. It was high at around 19.3% in January 2022 but then dropped to as low as 8.22% by June 2023. There was a recovery to 13.4% in March 2024, but after Bitcoin made its all-time high, altcoin dominance fell again to about 10.27% by July 16.

Ethereum has been the main driver behind any increases in altcoin dominance. When ETH prices went up, altcoin dominance followed, but other altcoins didn’t see the same level of interest or investment.

We can see this dynamic reflected in the Altcoin Season Index, which measures the performance of altcoins relative to Bitcoin. Typically, an Altcoin Season is deemed active when more than 75% of the top 50 altcoins, excluding stablecoins, outperform BTC.

In October 2023, the crypto market turned bullish, and altcoins gained strength. The index moved from 16 to a high of 84 in January 2024, suggesting an altcoin season was starting.

However, the momentum of spot BTC ETFs pushed altcoins aside, and the index dropped back to 16 by June 2024. Recently, as BTC lost some steam, the altcoin market picked up, and the index rose to 46, marking the quickest rise since January.

But Mt. Gox repayments and the German sell-off fears quickly brought the market down again, and the index dropped to 33 as of July 16.

Ethereum has played a major role in these movements. Data shows that whenever Ethereum prices increased, the Altcoin Season Index also rose, indicating that Ethereum is a key booster for the entire altcoin market.

For a real altcoin season to begin, this index needs to stay above 75 consistently for several weeks to months. Until that happens, Bitcoin will likely continue to dominate, with Ethereum playing a key supporting role.

Is the altcoin season around the corner?

A lot of the speculation about altcoins revolves around the upcoming events and historical patterns observed in the crypto market.

According to Wise Advice, a crypto analyst, the timing of altcoin season often aligns with Bitcoin halving events. Historically, after each Bitcoin halving, which reduces the block reward for mining new bitcoins, Bitcoin’s price tends to reach new all-time highs (ATH) about 1 to 1.5 years later.

This surge in Bitcoin’s price is followed by a sharp rise in Ethereum and other altcoins. For example, during the third halving bull run in November 2021, Bitcoin reached its ATH, and shortly after, Ethereum hit its peak at $4,800.

Similar patterns were observed in previous halving events, where altcoins like Solana (SOL), Polkadot (DOT), and Avalanche (AVAX) also saw their ATHs following Bitcoin’s rally.

The underlying mechanism behind this pattern is the flow of money in the market. Initially, investors flock to Bitcoin, driving its price up. As Bitcoin investors make profits, they often reinvest in Ethereum and other altcoins. Due to the lower market cap of these altcoins, even a relatively small influx of capital can cause substantial price increases.

This cycle of investment from Bitcoin to Ethereum and then to smaller altcoins leads to a temporary drop in Bitcoin’s dominance, making way for altcoin rallies and eventually towards altcoin season.

Meanwhile, Yann Allemann, co-founder of Glassnode, pointed out a recent market rotation where riskier equity assets outperformed more stable ones, a sign that could indicate a similar shift in the crypto market.

Comparing it to a similar event in November 2020, he suggests that we might see a massive rally in altcoins if this rotation continues. Back in 2020, such a shift led to a 400% increase in altcoin values over the next four months.

While these predictions paint a promising picture, it’s essential to approach them with caution. The market is inherently volatile, and while opportunities for gains exist, they come with risks that should not be overlooked.

Always do your research, stay informed, and avoid making decisions based purely on hype.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

[ad_2]