[ad_1]

According to FxPro senior market analyst Alex Kuptsikevich, the crypto market has been relatively stagnant, showing a decline in market cap until today’s increase.

Ethereum (ETH) trades at $2,977.88, a 2.6% increase over the past 24 hours. Its market cap has grown by 2.64% to over $357 billion, staying the second-largest cryptocurrency.

Kuptsikevich highlighted Ethereum’s challenges, noting its ongoing consolidation near the lower end of its price range and a “death cross” under its 200-day average, suggesting potential longer-term declines. This contrast between the short-term increase and the analyst’s medium-term concerns shows the complexities of market predictions.

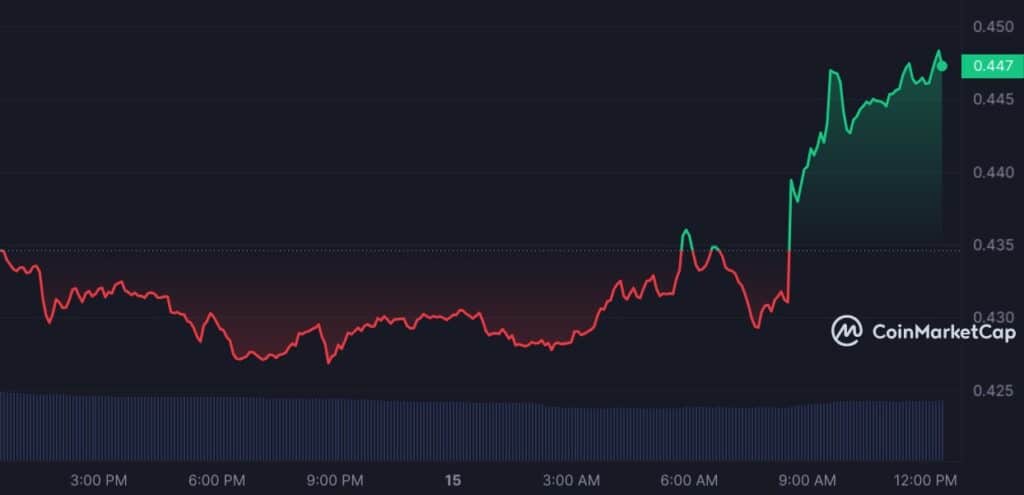

Similarly to Ethereum, Cardano (ADA) has seen a 2.43% rise in its price to $0.4461, with its market cap increasing by 2.42%. Positioned as one of the 10 largest cryptos, ADA’s trading near the lower end of its range suggests a cautious outlook despite the recent uptick, mirroring Ethereum’s consolidation trend.

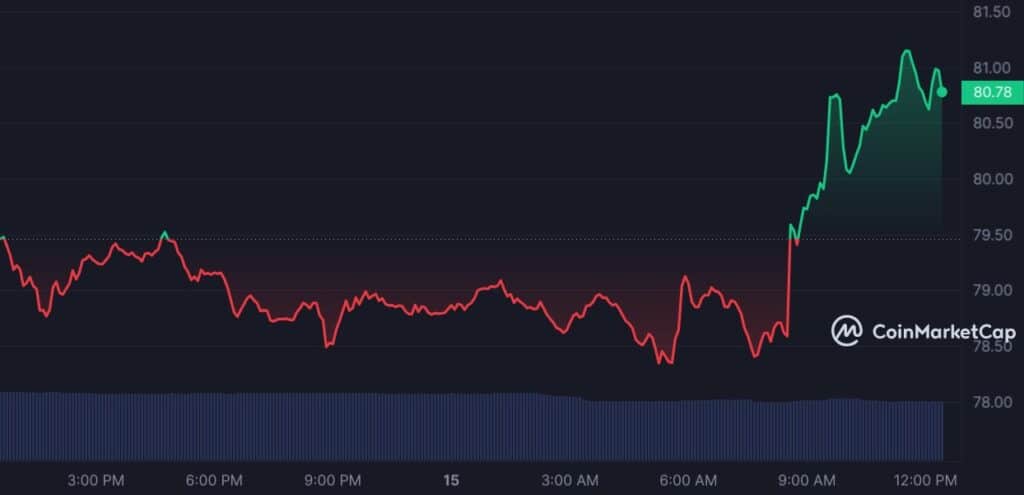

Litecoin’s (LTC) price has increased by 1.81% to $80.98, and its market cap has risen by 1.82%. As the 19th largest cryptocurrency, LTC continues to test its 200-day average, indicating a potential ongoing struggle to regain stronger bullish momentum. According to Kuptsikevich, Litecoin could face a protracted period of bearish trends if it fails to reclaim higher levels soon.

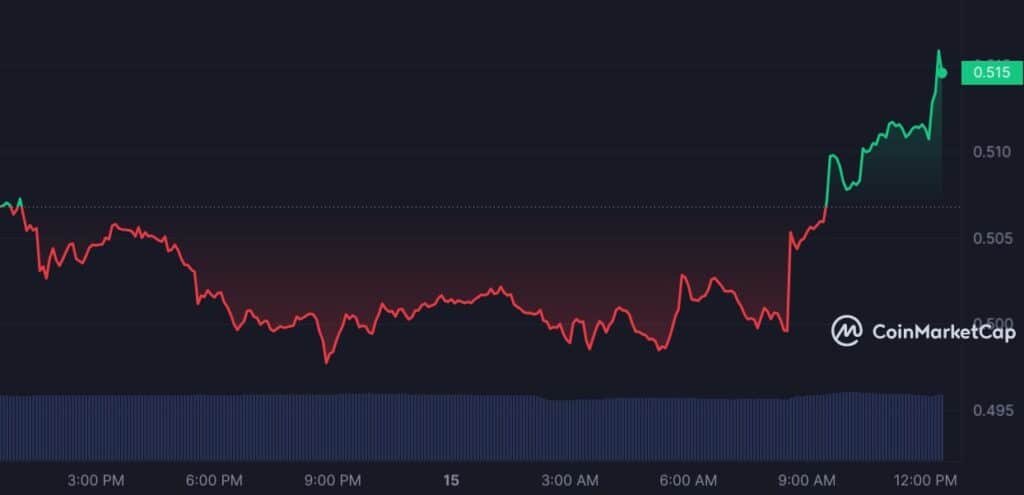

XRP is trading around a historically significant level of $0.50 after losing key support earlier in April.

“XRP broke below an upward support line, transforming it into resistance for subsequent peaks. This sets up a bearish scenario, potentially pulling back to long-term support at $0.25-30,” Kuptsikevich remarked, suggesting a cautious approach for investors.

XRP’s modest price increase of 1.57% to $0.5135 contrasts with a minor 0.56% increase in market cap. The 7th largest crypto, XRP’s break below key support levels earlier in the month points to a challenging road ahead despite some recovery, as indicated by the analyst.

In contrast, Solana (SOL) shows speculative potential, with predictions by Merkle Tree Capital suggesting a rise to $400 by November 2024, driven by meme coin popularity linked to the U.S. election campaign.

Since the Merkle Tree analysis, SOL has shown a notable surge. Its price has increased by 7.54% to $152.76, while its market cap has expanded by 7.53%, making it the fifth largest cryptocurrency.

While the short-term data from CoinMarketCap shows promising gains for these cryptocurrencies from U.S. inflation data, the medium-to-long-term analyses by Kuptsikevich paint a more nuanced picture that could be affected by other external economics.

[ad_2]