[ad_1]

The crypto market sentiment is seeing a major shift as leading digital assets continue their bullish momentum.

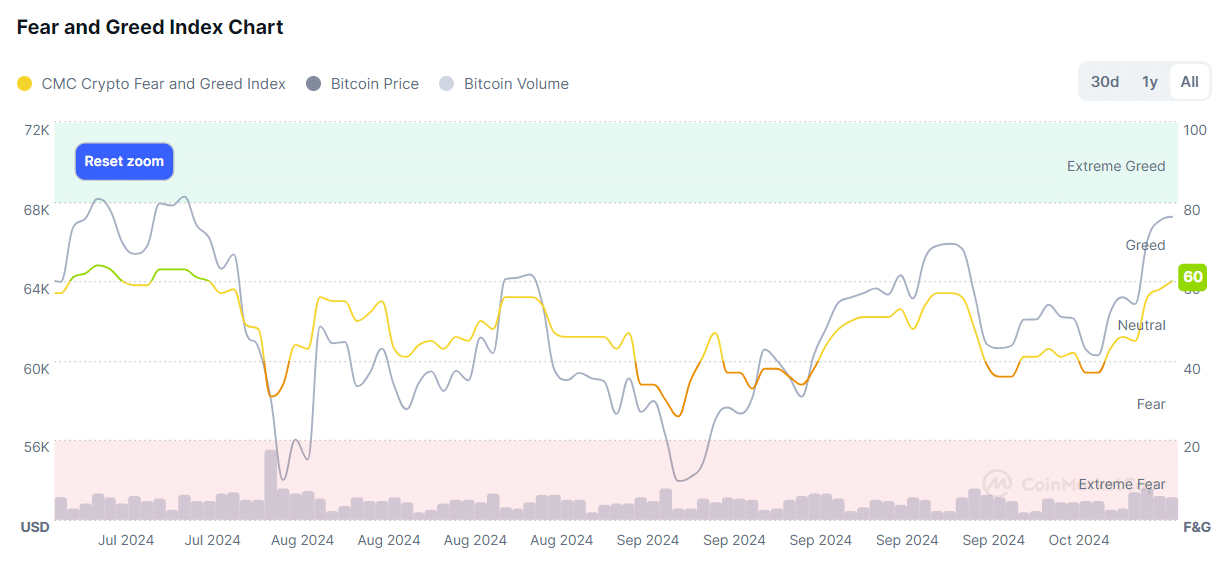

According to data provided by CoinMarketCap, the crypto fear and greed index entered the 60 zone today, signaling slightly greedy market conditions.

This is the first time the crypto market has hit the greed zone in six weeks—last seen on July 31. The major drop happened in early August as the Bitcoin (BTC) price plunged below the $54,000 mark.

The recent market-wide rebound came on the back of Bitcoin’s bullish momentum. The BTC price has constantly risen since Oct. 10, recording a 12% surge over the past week—Bitcoin briefly touched a two-month high of $68,375 on Oct. 16.

Despite a slight correction, Bitcoin is still up 0.3% in the past 24 hours and is trading at $67,350 at the time of writing.

According to data from IntoTheBlock, 95% of the Bitcoin holders are currently in profit, 3% are close to their initial investment and 2% are seeing losses.

At this point, short-term profit-taking would be normal, due to the increased number of holders in profit.

On the other hand, the number of daily active addresses in profit declined from 112,780 to 91,160 unique wallets between Oct. 15 and 16. The downshift shows that some investors might be aiming at a further price hike instead of taking profits right away.

One of the main reasons behind Bitcoin’s bullish momentum is the increased demand for the spot BTC exchange-traded funds in the U.S. Per a crypto.news report, these investment products recorded a net inflow of over $1.6 billion over the past four days—seeing $458.5 million in inflows on Oct. 16 alone.

[ad_2]