[ad_1]

Polygon has recorded a notable increase in on-chain activity despite the bearish flip in crypto that has sent MATIC plummeting.

While the Polygon (MATIC) price could continue to struggle amid the weakness that currently engulfs Bitcoin (BTC) and the broader crypto market, analysts say the surge in on-chain activity suggests a potential reversal for MATIC.

Data shows Polygon’s network has witnessed a spike in both daily active addresses and dormant coins movement.

Polygon on-chain activity spikes

Santiment notes that Polygon has witnessed a significant spike in dormant MATIC coins on the move. The platform points to the Age Consumed metric, an indicator that tracks movement of dormant tokens by measuring how many long held coins are moving across addresses.

Age Consumed data is a calculation that multiplies the number of coins on the move by the duration since their last transfer.

Notable also is the sharp increase in daily active addresses. According to Santiment’s data, a total of 3,369 addresses interacted on-chain on Polygon as the Age Consumed metric spiked. The active addresses count was the second-highest day of the year.

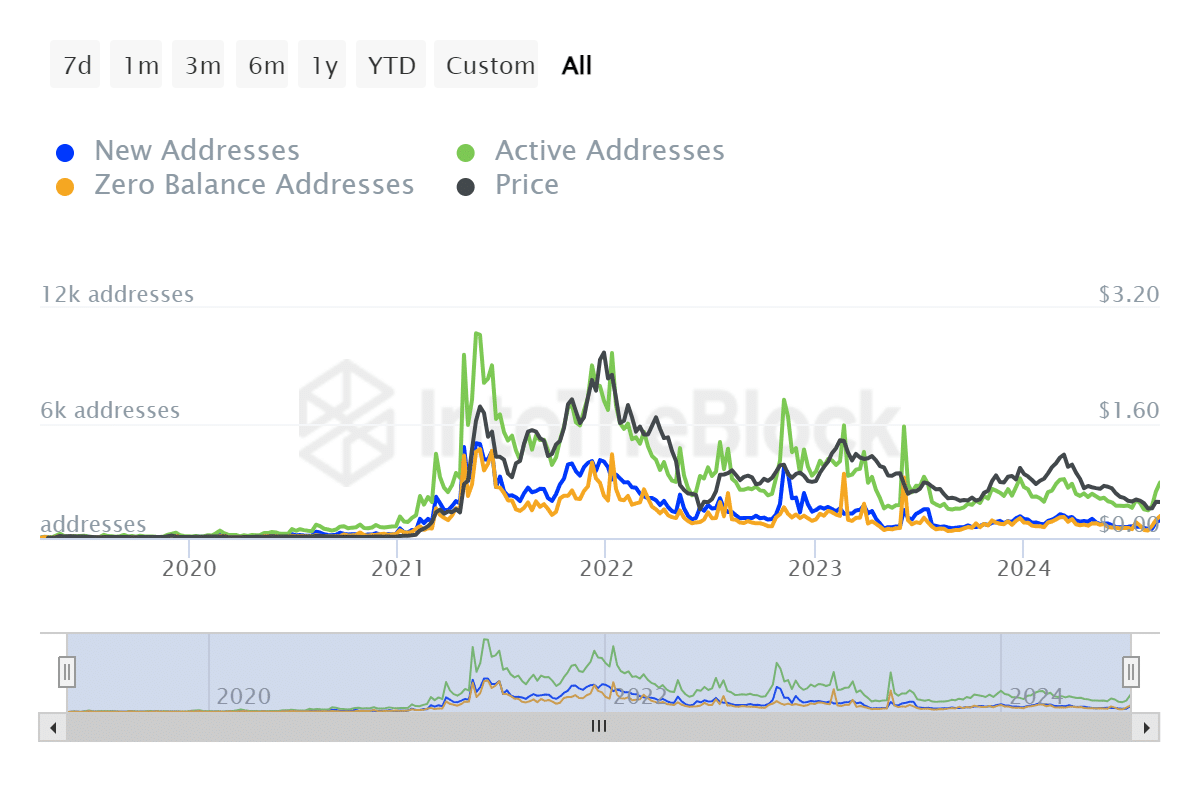

IntoTheBlock data also shows a surge in active addresses since Aug. 26, with more than 1,000 new addresses on Aug. 27.

What does this mean?

An increase in the Age Consumed metric often suggests a flip in sentiment for long-term holders. Historically, this has coincided with the particular token’s price witnessing notable changes.

Polygon has been among the many networks declining since crypto’s retrace began back in March. However, a notable spike in on-chain activity may be a sign that a MATIC reversal may be brewing soon. Active addresses and dormant coin spikes are common signals preceding this.

Santiment wrote on X.

In Polygon’s case, the Age Consumed measure spiked to 69 billion MATIC as the altcoin’s price dropped amid the latest crypto weakness. The local top relating to this was around $0.58, and Polygon’s price has dropped 14% so far.

Despite this weakness, the two on-chain indicators suggest investors may view MATIC’s dip as an opportunity to buy low.

[ad_2]